What is Medicare Part D?

Medicare Part D covers prescription drugs. Medicare Part D is a federal program that began in 2006. It provides Medicare beneficiaries with access to retail prescription drugs at affordable copays. Prior to 2006, people on Medicare had to pay high retail prices for their medications. This program helps seniors pay for much-needed medications.

Medicare Part D is coverage for retail prescription drugs that you obtain from a retail pharmacy. This voluntary program allows you to access medications at a more affordable rate and helps provide coverage against catastrophic drug costs.

You do not enroll in Medicare Part D via Social Security. Instead, you will choose a Medicare Part D plan offered by a private insurance company in your state.

Medicare Part D Cost

How much is Medicare Part D?

Medicare Part D costs include several things:

- First, there is a monthly premium that you will pay for the insurance itself.

- Next, there is cost-sharing that you will pay at the pharmacy for your medications. That cost-sharing may include some deductible spending if your Part D plan has a deductible.

- Copay Tiers – depending on the cost of the medication, it will fall into a tiered classification. Within those tiers, you will pay a different amount for the medication. Some of the Tier 0 or Tier 1 medications will have a $0 copay.

Medicare Part D Monthly Premiums

The monthly premiums for Part D drug plans vary by state and insurance company depending on the specific plan that you choose.

There are many Medicare Part D plans to choose from. Every insurance company sets its own formulary (list) of medications that are covered by the plan. What medications are covered and what tier they fall into determine what the cost of that monthly premium will be.

It’s important to choose the plan with a formulary that offers the medications you need. Don’t always look at the cheapest plan. If you just enroll in the cheapest plan without checking the plan’s formulary, you may later learn that the plan does not cover one of your medications. It may also benefit you to pay a slightly higher monthly premium to find a plan that covers your medication at a lower copay.

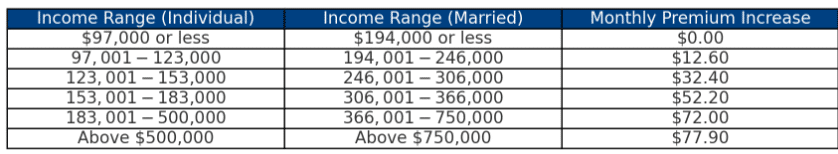

Some people with higher incomes may have to pay more for their Medicare Part D plan. If you earned more than $97,000 filing individually or $194,000 filing jointly, then Medicare will also require you to pay extra for your Part D coverage. This is called the Income Monthly Adjusted Amount (IRMAA). Check with your Medicare documents for the updated Part D premiums by income for 2025.

2025 Medicare Part D Premiums by Income

Medicare Part D Cost-Sharing

There are cost-sharing costs when you go to the pharmacy to pick up your prescriptions. Most plans require a deductible to be met first, then you will pay a copay for each covered medication.

Medicare Part D Deductible

The Center for Medicare and Medicaid Services sets the minimum guidelines for Part D plans each year. All drug plans have 4 stages, and Medicare sets the threshold for each stage every year.

The first stage is the Medicare Part D deductible. In 2025, this deductible is $525. This means that each insurance company can require you to meet a $525 deductible before your benefits kick in. The carrier can never charge a higher deductible than what Medicare allows for that year. To offer a richer benefit, the carrier can decide to offer as little as a $0 deductible.

In general, the drug plans that charge the deductible will have lower monthly premiums and lower drug copays. For those companies that have lower prescription deductibles or waive your deductible, the premiums and copays are usually higher than plans that charge the deductible.

Medicare Part D Copays

Medicare Part D plans usually provide a 5-tier formulary:

- Tier 1: Preferred generic medication

- Tier 2: Non-preferred generic

- Tier 3: Preferred brand

- Tier 4: Non-preferred brand

- Tier 5: Specialty drugs

The insurance company will set the copay for each tier. For example, one company might charge a $3 copay for Tier 1 medications, while another charges $5. More costly medications will fall into the higher tiers. It’s always important to discuss the cost of medications when you meet with your healthcare provider. This is why it’s important to review the plan’s formulary to make sure your medications are covered and to know what you can expect to pay for those medications.

Medicare offers a Drug Finder Tool. Go to www.Medicare.gov, enter your zip code and medications, and the Drug Finder Tool will show you which plans in your state will be most cost-effective for you. We encourage you to review your Part D plan annually to ensure you will have the lowest out-of-pocket drug spending for the next plan year.

Extra Help for Part D Costs

If you qualify, the federal government offers help with paying for your Part D drug plan expenses. This is called the Low-Income Subsidy (LIS). Anyone can apply for this through Social Security, but help is awarded based on lower income and limited resources. Based on your household size, you must have an annual income that falls below 150% of the Federal Poverty Level.

Beneficiaries who qualify will receive assistance with paying their monthly Part D premiums, their annual Part D deductible, and their copays for retail medications. There are different levels of qualification. The subsidy level generally determines how much assistance you will get with your monthly premiums. Someone who qualifies for a full subsidy would have 100% of their Part D premium paid for, up to the benchmark allowed by Medicare for that year. If you think you may qualify, it will be worth your time to contact Social Security for an application.

Medicare Part D Enrollment

Medicare Part D is a voluntary program. Even though it’s voluntary, without it you may pay a lot for medications that you need down the road. Never decide if you should or should not take Part D based on your needs today. Needs can change tomorrow. If Medicare will be your primary coverage, you should enroll in Part D when you first become eligible at age 65.

Many people who are still working at age 65 delay their enrollment into Part D until they retire. As long as your employer insurance has drug coverage that is as good as or better than Medicare Part D, you can delay enrollment without penalty.

How Do I Enroll in Part D?

Enrolling in a Medicare Part D plan can feel overwhelming, but you don’t have to navigate it alone. At HFC Insurance, we specialize in guiding you through the enrollment process, ensuring you find the right plan for your needs. You must enroll in a Part D plan that serves the area where you live. While you can enroll directly through a Medicare Part D provider or via Medicare’s website, working with an expert agent like HFC Insurance means you have a trusted resource by your side for any questions or challenges with your drug plan.

Additionally, if you’re considering a Medicare Advantage plan that includes Part D coverage, it’s crucial to confirm that the plan covers your specific medications. Remember, you can only be enrolled in one Part D plan at a time, whether it’s part of a Medicare Advantage plan or a standalone plan. Let our experts help you navigate these choices with confidence.

Contact HFC Insurance today for personalized guidance and peace of mind as you enroll in the Medicare Part D plan that’s right for you.

When Do I Enroll in Part D?

Joining a Medicare Part D drug plan can only be done during certain windows of time. You are eligible to enroll in Part D when you first enroll in Medicare. This Initial Enrollment Period (IEP) lasts seven months.

It includes the three months before you turn 65, your birth month, and the three months following. A similar window exists for people who first become eligible for Medicare due to disability.

Medicare Part D also has an Annual Election Period which runs from October 15 – December 7. During this time, you can enroll or disenroll from any drug plan. This is because each Part D plan’s benefits, formulary, pharmacy network, provider network, premiums, and/or copayments/coinsurance may change on January 1 of the following year. Since all those things can change, Medicare gives you an annual election period to make a change. This is the time to review your prescription needs.

To assist you in your review, the insurance company will mail you an Annual Notice of Change each September. It will list everything that is changing with your plan for the following year.

If you are fine with the changes, your Part D drug plan will automatically renew in January. This is why the annual review of your medications is really important. Needs do change!

Special Election Periods for Medicare Part D

Once enrolled in Medicare Part D, you are locked into the plan for the rest of the calendar year. You must wait for the next Annual Election Period to change or disenroll. However, Medicare recognizes that there might be certain circumstances in which you need to change mid-year. They have created Special Election Periods (SEP) for this.

An example would be if you move out of state or lose your group medical coverage mid-year. These kinds of situations create a short Special Election Period during which you can make the necessary change. Be aware that your insurance agent cannot solicit you for Part D, so if you wish to enroll, you must initiate that with your agent.

Is Medicare Part D Right for Me?

There are dozens of drug plans offered in most states. Fortunately, we can assist you with evaluating each plan based on your individual medications. We’ll help you determine which drug plans offer the specific medications you need at the lowest copays.

Click here to watch our Medicare video series.

*If you have an insurance need, we have a solution. We provide solutions for home & auto, health and Medicare insurance, life & dental coverage, employee benefits and commercial insurance. Give us a call at 803-286-1161.