Best Home Insurance in Rock Hill SC

Owning a home in Rock Hill, SC, goes beyond simply having a roof over your head—it’s an investment in your future, a space to create lasting memories, and a sanctuary for your loved ones. But when the unexpected strikes, from Rock Hill’s unpredictable storms to home-related incidents, having the best home insurance in Rock Hill, SC, serves as your safety net, protecting everything you’ve built.

Home insurance in Rock Hill is like the backbone of your home—it may not always be visible, but it’s essential for long-term protection. Skimping on the right coverage is like cutting corners during construction. It might save you a little money upfront, but when disaster strikes, you’ll wish you had reinforced your coverage.

Here’s a guide to finding the best home insurance in Rock Hill, SC—coverage that not only protects your home but also fits your budget. When it comes to balancing the right coverage with great service, HFC Insurance is your local expert. We’re more than just an insurance agency—we’re your Rock Hill neighbors, committed to offering personalized home insurance protection.

Why Home Insurance in Rock Hill SC, Is Essential

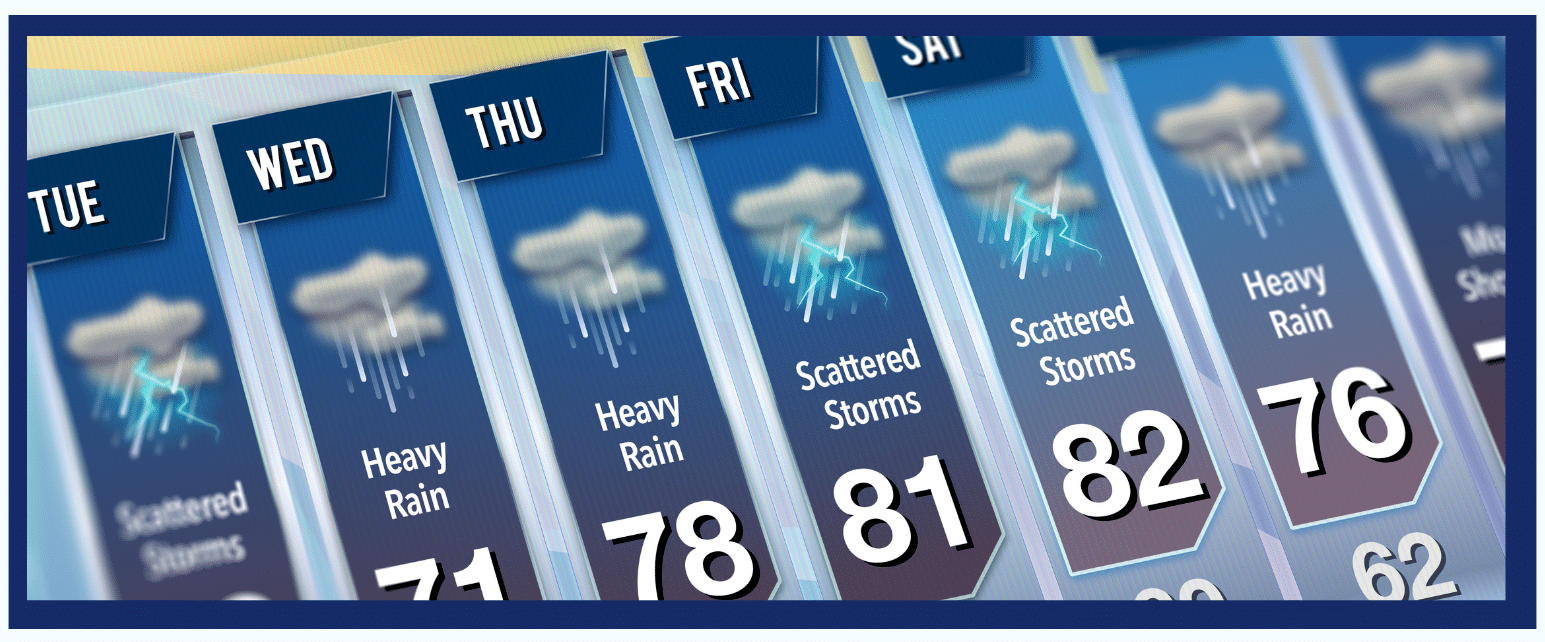

Living in Rock Hill comes with its own unique set of risks. While the city is known for its vibrant community and Southern charm, it also faces unpredictable weather. From summer thunderstorms to the risk of hurricanes reaching inland, Rock Hill homeowners need comprehensive insurance to protect against these natural hazards.

The Unpredictable Weather in Rock Hill, SC

Imagine this: It’s a hot summer afternoon in Rock Hill, SC, and out of nowhere, a severe thunderstorm rolls in. Lightning strikes, and suddenly, the large oak tree in your yard is threatening to fall on your home. In moments like these, having the right home insurance makes all the difference.

Not all home insurance policies cover “acts of nature” equally. Some may leave you with hefty tree removal bills or insufficient coverage for storm-related water damage. This is where choosing the right policy for Rock Hill’s weather becomes crucial.

Rising Property Values in Rock Hill, SC

Rock Hill’s housing market continues to grow, with home values steadily increasing. While this is good news for homeowners, it also means that if your insurance policy was written based on your home’s value from years ago, you could be underinsured. If a disaster strikes, you may not have enough coverage to rebuild your home at today’s costs. That’s why it’s critical to update your home insurance policy in Rock Hill to reflect current market values.

Customizing Home Insurance Coverage for Rock Hill, SC

How can you ensure you’re fully protected? The best home insurance policies in Rock Hill, SC, are customized to reflect your home’s value and local risks. A one-size-fits-all policy won’t suffice. You need coverage that’s tailored to your specific home and its unique risks.

At HFC Insurance, we understand Rock Hill’s weather patterns and housing market, offering personalized home insurance that meets your needs. We craft policies that protect what matters most to you, without offering generic solutions.

Types of Home Insurance Coverage in Rock Hill, SC

When considering home insurance in Rock Hill, there’s no single solution that fits everyone. Every homeowner’s needs are different, and unfortunately, many people discover they’re underinsured when it’s too late. Here are the key coverage types you need to consider:

Key Coverage Types for Rock Hill Homeowners

- Dwelling Coverage: Protects your home’s structure from damage caused by fires, storms, and wind.

- Personal Property Coverage: Safeguards your belongings—furniture, electronics, and more—in case of theft or damage.

- Liability Coverage: Covers legal expenses if someone gets injured on your property.

- Additional Living Expenses (ALE): Pays for temporary living costs if your home is uninhabitable during repairs.

Many homeowners in Rock Hill don’t realize they are underinsured until disaster strikes. If your home was insured for $200,000 but is now worth $300,000, you might face a huge financial gap. HFC Insurance offers personalized service to ensure your policy grows with your home’s value and changes in the market.

How to Choose the Best Home Insurance in Rock Hill, SC

Selecting the right home insurance provider in Rock Hill is just as important as choosing the right coverage. Here’s what to keep in mind:

Key Factors in Choosing the Right Insurance Provider

- Financial Stability: Ensure the company is financially strong enough to pay claims during widespread disasters.

- Claims Process: A fast, fair, and simple claims process can make all the difference when disaster strikes.

- Local Expertise: Choose a provider that understands Rock Hill’s unique risks, from flooding to wind damage.

HFC Insurance stands out by offering competitive rates and a deep understanding of Rock Hill’s local risks. Our agents live and work in the community, ensuring you have the right coverage for your home’s needs.

Finding the Right Balance Between Price and Coverage

in Rock Hill, SC

When searching for home insurance in Rock Hill, SC, many people are tempted to choose the cheapest option. While saving money is important, choosing a policy that’s too cheap may leave you vulnerable when you need coverage the most.

The Pitfalls of Cheap Home Insurance

Going for the lowest-priced insurance may leave you with coverage gaps when you need it most. It’s like patching up a roof with tape—it might work for a while, but you’ll regret it when the next storm hits.

Avoid Overpaying for Unnecessary Coverage

On the other hand, some homeowners overpay for coverage they don’t need. For instance, while earthquake insurance may not be necessary in Rock Hill, flood insurance could be essential. Understanding your home’s actual risks allows you to tailor your coverage without overspending.

Balancing Price and Protection

The best home insurance policy is one that provides the right coverage at a reasonable price. Here are a few tips:

- Review Your Deductible: A higher deductible can lower your premium, but make sure it’s a number you’re comfortable paying out of pocket.

- Ask About Discounts: Many insurers offer discounts for bundling policies, installing security systems, or going claim-free.

- Tailor Your Coverage: Focus on Rock Hill-specific risks like storms and avoid paying for unnecessary extras.

At HFC Insurance, we help you strike the perfect balance between cost and coverage, offering personalized service so you never have to choose between price and protection.

Protect Your Lancaster Home with the Right Insurance

Choosing the best home insurance in Rock Hill, SC, isn’t about picking the first policy you see. It’s about ensuring your home and family are protected against life’s unexpected events—whether it’s a storm, fire, or other damage. Take the time to review your policy, work with an agent who understands Rock Hill’s risks, and make sure your coverage fits your home.

At HFC Insurance, we’re more than just an insurance provider—we’re a trusted partner in safeguarding your greatest investment. With our combination of tailored coverage, competitive pricing, and personalized service, we aim to give you peace of mind for years to come.