Comparing car insurance isn’t just about finding a lower price—it’s about understanding what your policy actually covers. At HFC Insurance, we help Lancaster SC drivers compare car insurance options from multiple top-rated carriers, reviewing coverage limits, deductibles, discounts, and potential gaps. As a local independent insurance agency, we take the time to explain your options clearly so you can choose coverage that fits your needs and protects you properly—not just today, but long term. You may be asking, why HFC Insurance?

Call for your free car insurance quote today. Call or click now to speak with a local agent who understands Lancaster drivers. We also service Indian Land SC.

Here’s what makes us different:

-

Local agents who live and work right here in Lancaster, SC

-

Customized policies to fit your unique needs—not cookie-cutter plans

-

Real, ongoing service during the policy—and when you need to file a claim

-

Access to discounts like student, safe driver, and bundling

Online quote tools may seem fast and easy, but they often miss important coverage details. For example:

-

Do you drive through flood-prone areas?

-

Use your car for work or deliveries?

-

Have a teen driver in the house?

Most online systems don’t ask—and don’t adjust for your personal risks.

At HFC Insurance, we take time to ask the right questions, explain your options, and find the best value—not just the cheapest quote. Our clients often discover important coverage gaps they didn’t even know existed. Are you looking for cheap insurance? Read more on the cheapest car insurance options in Lancaster.

We tailor each auto policy based on what your life looks like right now—and where you’re headed next. Whether you:

-

Drive daily for work

-

Have a new driver in the household

-

Recently bought a car or plan to soon

-

Need coverage for an RV, boat, or classic car

We’ve got your needs covered, and we’ll be here as those needs change.

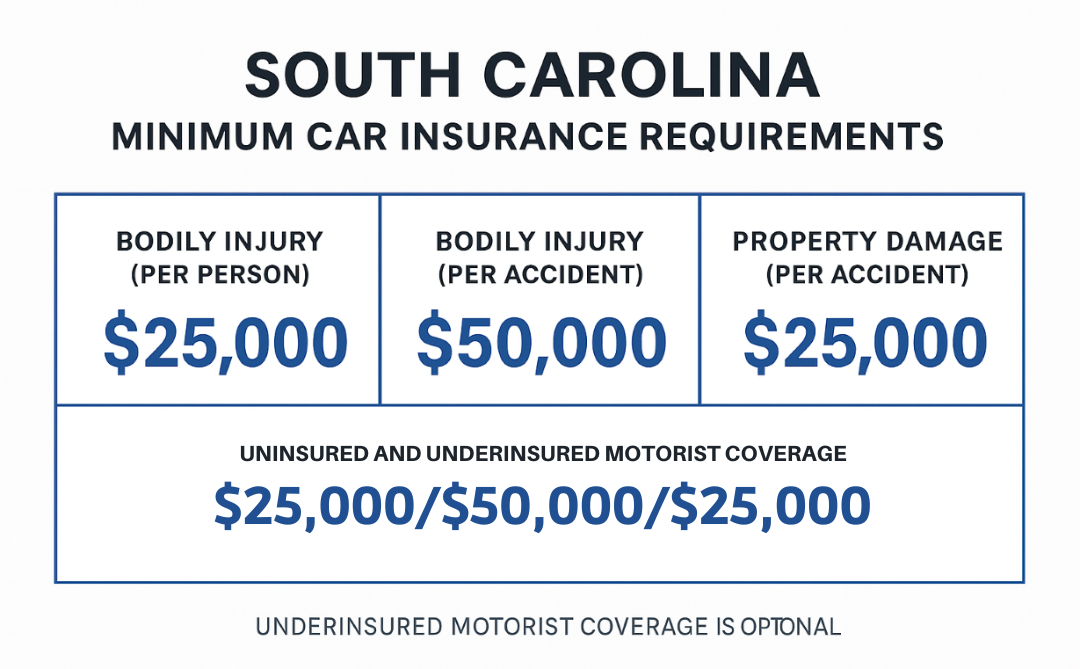

South Carolina requires liability coverage of at least 25/50/25. We’ll help you decide if that’s enough for your situation.

Rates are based on traffic patterns, local weather risks, claims frequency, and more. Local agents know how to work around those factors.

We work with multiple carriers to help you compare value—not just price. The right policy is the one that protects you properly.