In today’s competitive hiring market, most employers do a good job of putting in a wide range of base employee benefits – health insurance, life, disability, vision, dental, etc. Many benefits packages, though, are geared toward serving every employee at the business or at the company. That is a great start, but too often unintentionally discriminates against the executives and key employees that have higher incomes and are vital to the business. With a simple census and benefits audit, you may find that many of your best group clients are in need of a benefit restoration plan for their key employees.

EXECUTIVE BENEFITS

Helping Employers Protect Key Employees

Executive Disability Coverage

- Adequately insures key employee income

- Levelizes coverage for all employees

- Valuable retention/recruiting tool for existing/future employees

- Facilitates disabled employees’ timely return to work

WHY EXECUTIVE INCOME PROTECTION MATTERS:

PROTECTS BIGGEST ASSET

Insures key employee income in the event of a disability

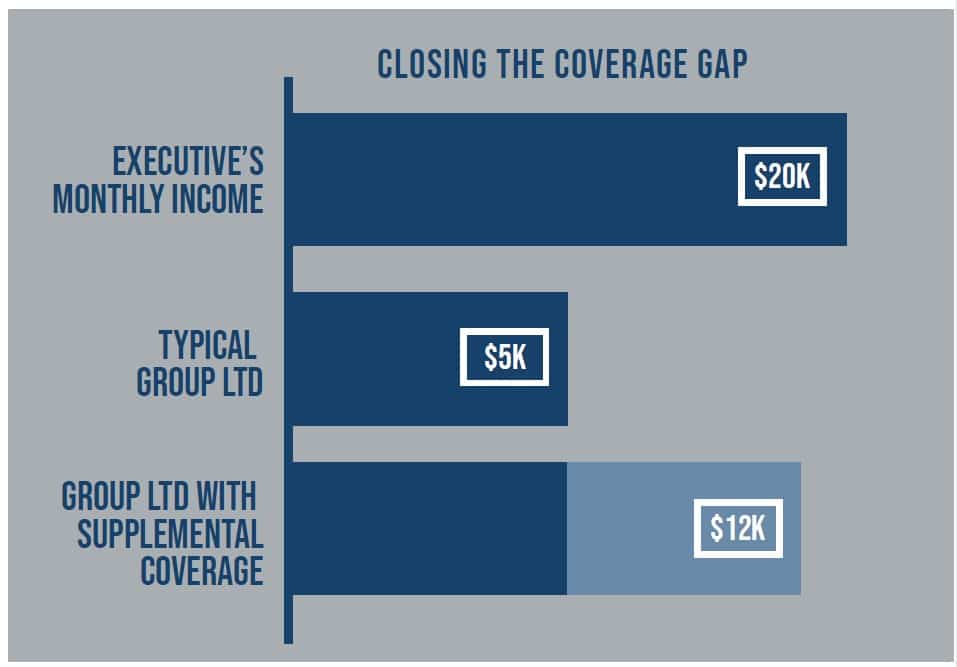

COMPREHESIVE COVERAGE

Supplements deficiencies of group only plans

PORTABLE

Policies can be kept in the event of a career change

AVAILABLE INDIVIDUALLY

Can be purchased without employer contributions

Key Person Life Insurance Policy

What is a Key Person Policy? It is a term that refers to any employee, partner, or owner who makes a significant contribution to a business. The intent is to provide financial assistance to a business suffering loss after a key employee dies. It’s when you heavily rely on one or two significant people.

A study found that following a founding entrepreneur’s death approximately 60% of a business’s sales are lost. The death of a key employee drops the business survival rate by 20% for two years following the loss.

People you need to consider when purchasing a key person insurance policy:

- Engineers

- Difficult to replace personnel

- Heads of product development

- Leading sales personnel

- C-suite executives such as a CEO or COO

- Partners or co-owners of a firm

Some Key Pointers:

- Key person insurance is paid using after-tax dollars and is not tax-deductible. The only exception may be if the employee’s taxable income increases because of the insurance. Make sure you talk with your company accountant.

- The amount of coverage you need on each key person in your company will be dependent upon the impact that person’s loss would have on the company. To reach this determination, you need to consider the revenue and profit you can attribute to that employee.

- Percentage of revenue or profits—multiply revenue or profit the employee generates by the number of years it may take to replace them. This is usually an eye opener!

- Cost to replace—a total of the costs to replace the key employee include locating, hiring, and training the replacement, plus the loss of income during this process.

A key point. Key Person insurance provides financial security for a company only in the event a key employee dies. It does not cover the loss of a key person who decides to leave your company due to retirement or to take a job with another company.