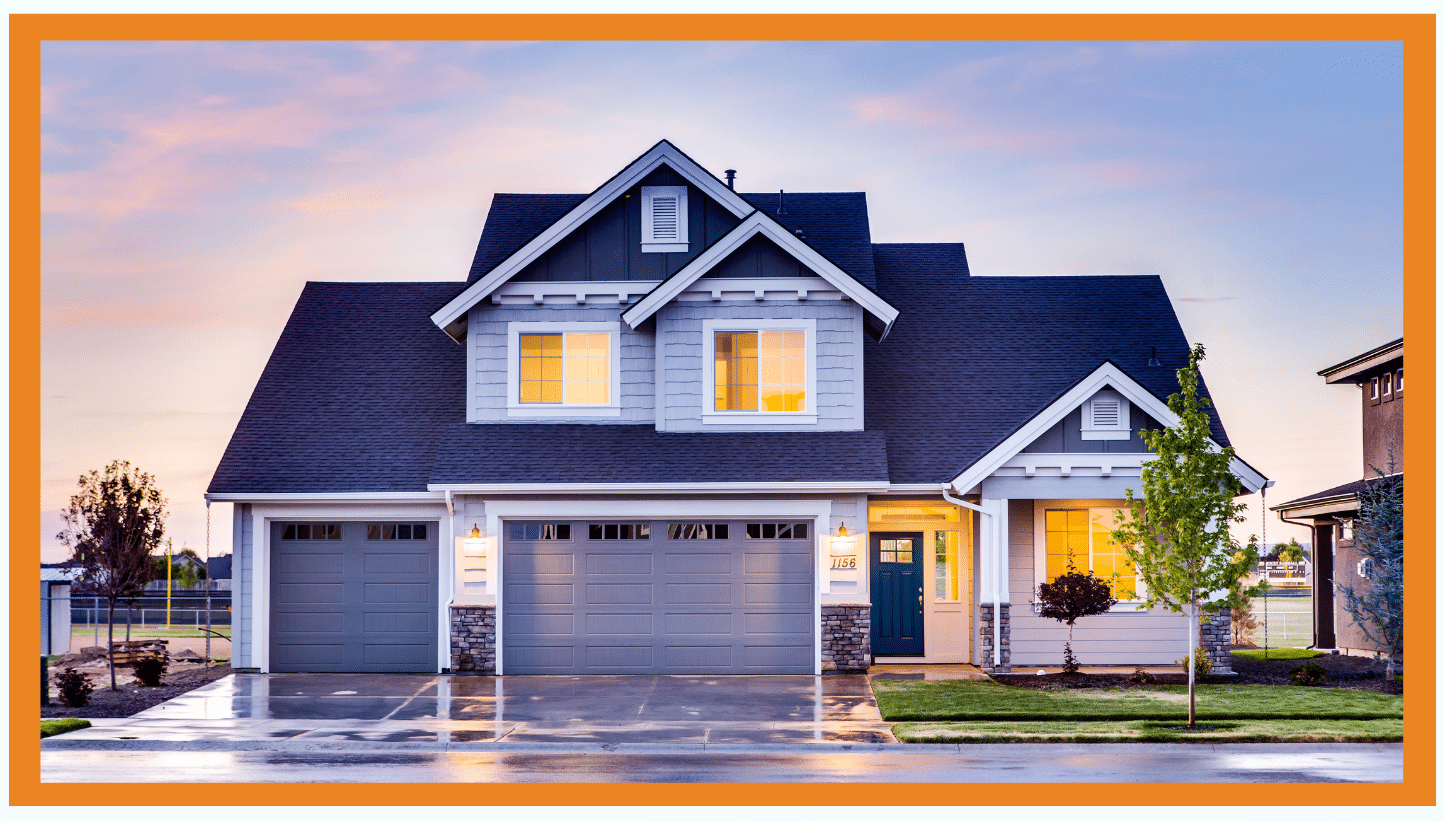

Picture yourself navigating through a dense forest with only a vague map in your hands. Now imagine a local guide stepping in—someone who knows every hidden path and secret corner. Suddenly, the journey feels safer and more certain. That’s exactly what it’s like when you work with a local insurance agent to navigate the often confusing world of home insurance. In the maze of coverage options, policy details, and potential risks, local expertise isn’t just helpful—it’s essential.

In today’s rapidly changing environment, where local regulations shift and natural risks evolve, having an expert who understands the terrain can make all the difference. That’s what we’ll explore today: the undeniable value of local guidance in building a home insurance policy that’s not only adequate but perfectly tailored to your needs. If you are looking for car insurance in Lancaster SC and want to maximize your protection while saving more, consider bundling your home coverage with your car insurance.

Many homeowners are unaware of the specific risks their property faces depending on its location. For instance, homes in one area might be prone to flooding while another is susceptible to wildfires. Generic online insurance policies often overlook these nuances, leading to significant gaps in coverage.

Furthermore, local building codes and regulations can dramatically influence what kind of insurance coverage is appropriate. Homeowners often find themselves underinsured because they didn’t realize that newer regulations require different standards of coverage.

This is where the profound value of a local insurance agent comes into play. With in-depth knowledge of both the physical and regulatory landscapes, local agents provide invaluable guidance. They ensure that your home insurance policy covers the specific risks unique to your area and that it meets all local legal requirements. Just like a skilled guide leading you through that dense forest, a local agent helps you avoid pitfalls and ensures a safe passage through the complexities of home insurance. Are you looking for the cheapest insurance in Lancaster SC? Read our post on the Cheapest Insurance in Lancaster SC ,first.

Working with a local agent also means building a relationship that extends beyond the initial purchase of a policy. As your life changes—perhaps through home improvements or acquiring valuable personal property—your agent can adjust your coverage to match. It’s a dynamic relationship that adapts to ensure your coverage continuously aligns with your current circumstances, much like a guide who stays by your side throughout a journey, always ready to assist as the terrain changes.

In the world of home insurance, local knowledge is more than just a benefit—it’s a necessity. By choosing a local insurance agent, you’re not just buying insurance; you’re investing in a partnership that will safeguard your home with the precision and care it deserves. Just as a seasoned guide turns a treacherous hike into a manageable trek, a skilled local agent transforms the process of securing home insurance from a daunting task into a straightforward, secure, and personalized experience. Are you a first-time home buyer? Read our article on Home Insurance for First-Time Buyers in SC.