Navigating Medicare in Lancaster, SC doesn’t have to be stressful. At HFC Insurance, we specialize in helping seniors and those turning 65 explore their Medicare Advantage plans, Medicare Supplement insurance, and Part D prescription drug options with confidence. As your local Lancaster Medicare agents, we provide clear education, a personalized review of your prescriptions, and access to top carriers so you get coverage that truly fits your needs. Unlike national call centers, our team is right here in Lancaster, SC, offering face-to-face guidance, lifetime support, and peace of mind. Whether you’re enrolling for the first time or reviewing your current plan, HFC Insurance makes Medicare simple, stress-free, and tailored just for you. Not ready for Medicare yet? Learn about your Health Insurance options in Lancaster, SC.

Lancaster SC Medicare Plans | Medicare Advantage & Supplements | HFC Insurance

Insurance Made Easy.

You Relax While We Take Care of The Rest.

We Make It Easy!

Medicare Can Be Stressful and Confusing.

Do What Many Have Done. Call Today!

Our Promise to You

- Clear Education: We’ll give you straightforward information about Medicare, breaking down your options in simple terms.

- Customized Carrier Options: We research and recommend the best Medicare plans tailored to your unique needs.

- Personalized Support: Our client concierge service ensures you always have a direct contact in our office—no call centers, no endless holds.

- Comprehensive Medications Review: We review your prescriptions to find the Part D plan that’s best for you.

Your Solution for Medicare Peace of Mind

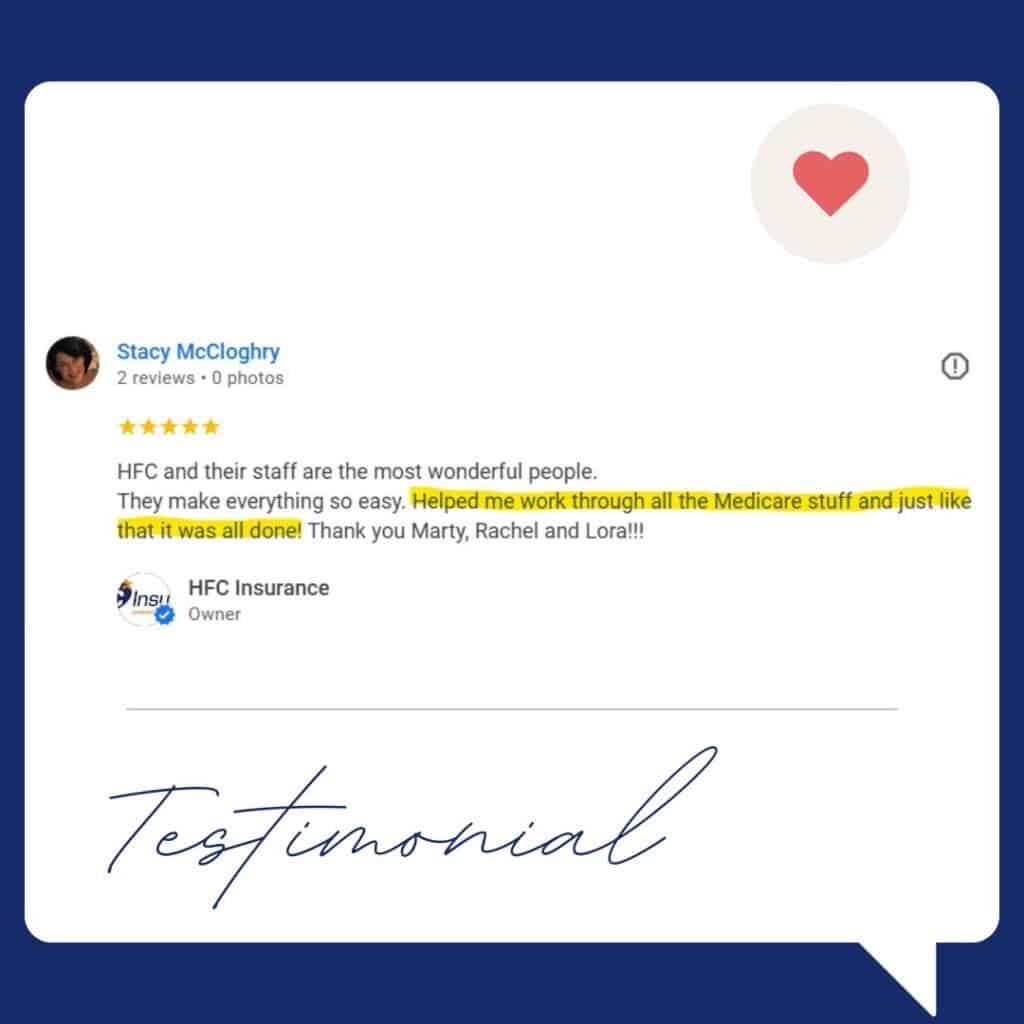

Choosing HFC Insurance means choosing peace of mind. We’ll guide you through every step of the Medicare process, making sure you’re educated, less stressed, and happy with your coverage. Imagine feeling confident and relaxed about your Medicare decisions. With us, you’ll have a direct contact in our office, ready to assist you whenever you need. Say goodbye to confusion and frustration, and hello to a worry-free Medicare experience with our Client Concierge Service and our Sundown Promise. Don’t let Medicare overwhelm you—contact us today for a free consultation and start your journey to hassle-free Medicare coverage.

Why Choose HFC Insurance?

- We’re Local and Part of the Lancaster County Community: Visit us in person—we’re right here in Lancaster, SC.

- Direct, Local Contact: Your calls are answered by our Lancaster, SC office—not a call center.

- Medication and Carrier Reviews: We review your medication list to find the best carrier options.

- Customized Medicare Advantage Networks: We research the Medicare Advantage network that’s right for you.

- Lifetime 5-Star Customer Service: We provide ongoing, top-notch service you can rely on.

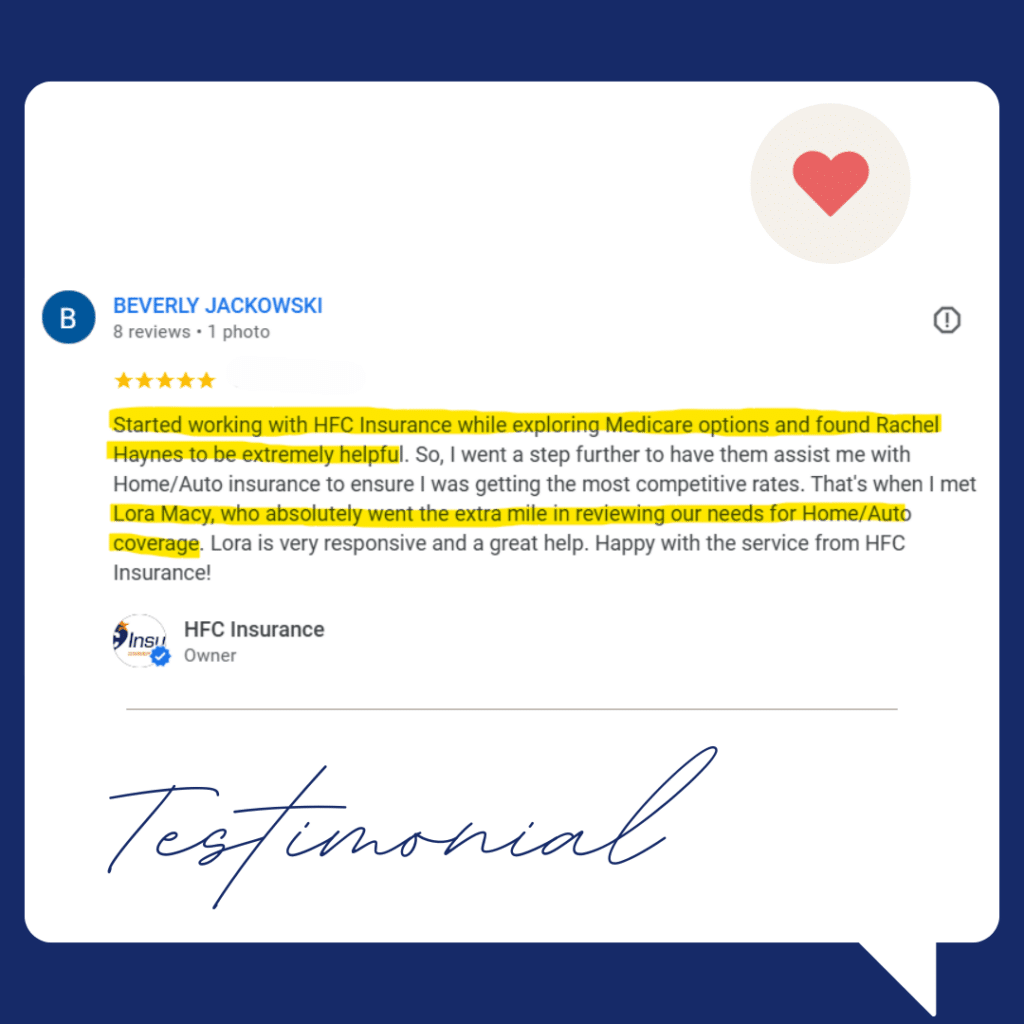

We’ll research all the insurance companies in our area offering the policy you need. Our agency works with more than 30 insurance companies, so if better rates are out there, we’ll find them for you. To learn more about Medicare, visit our Medicare Resource page for detailed information on Medicare’s different parts. As a trusted Insurance Agency in Lancaster SC, we help retirees simplify all of their insurance, not just Medicare. Just like Medicare, choosing the right car insurance in Lancaster SC can be confusing. That’s why local expertise matters.

What Happens Next?

Step 1: Schedule Your Visit

Reach out to us by phone or email to set up your visit. We’re local, right here in Lancaster, SC, and ready to meet with you in person.

Step 2: We Handle the Details

Relax and let us do the heavy lifting. We’ll review your medications, research the best Medicare Advantage networks, and recommend customized carrier options. If a Medicare Advantage plan isn’t the right fit, we’ll also search for the best Medicare Supplement plan tailored to your needs. We make it simple on your end, ensuring you’re well-informed and confident in your choices.

Step 3: Collaborate and Enjoy the Rewards

Together, we’ll finalize your Medicare plan, and you’ll experience the peace of mind that comes with knowing you’ve made the best choice. Our lifetime 5-star customer service means we’re always here to support you, ensuring your Medicare journey is smooth and stress-free.

Hello, We are Lora Macy & Rachel Haynes.

We are your go-to insurance agents with over 40 years of experience in the industry. We are dedicated to provide expert guidance, tailored to your unique needs, and ensuring you feel supported and confident in your insurance choices. With HFC Insurance by your side, you’re not just getting an agent—you’re gaining a friend and trusted partner who genuinely cares about your peace of mind. Whether you’re navigating complex policies or simply need a friendly ear, we are always here to help you every step of the way.