Medicare Part A is your hospital coverage. It provides you with affordable inpatient care. So, what’s does Part A cover? It’s going to cover a semi-private room with a bed for you, and all your regular meals while you are there. It will cover medications furnished to you by the hospital and any necessary lab services or medical supplies.

You may get your inpatient care at an acute care hospital, a critical access hospital, an inpatient mental healthcare hospital or at an inpatient rehabilitation facility.

What Does Medicare Part A Cover?

In addition to Medicare hospitalization coverage, Medicare Part A also covers post-hospital skilled nursing and short-term post-hospital home health care, as long as it is medically necessary. Part A covers hospice services which may include palliative care, DME, counseling, and social services. Medicare hospice coverage also provides short-term respite care for caregivers to have a rest. Medicare does NOT cover long-term care, such as extended stays in a nursing home.

There are some things that you might think would fall under Part A but sometimes fall under Part B, such as outpatient surgeries. In general, what is covered by Part A is generally hospital-related for immediate or acute care of an injury or illness.

How Much Does Medicare Part A Cost?

Is Medicare Part A free?

The misconception is, Medicare is free. Most beneficiaries will pay nothing for Medicare Part A at age 65 because they have already pre-paid it. We all pay taxes (FICA & are matched by our employers) during our working years (10 years or 40 quarters) that are specifically for our future Medicare hospital coverage during retirement. These taxes go to offset the cost of Part A when we need it.

If you have not worked 10 years or 40 quarters, you can purchase Part A as long as you have been a legal resident or green card holder for at least 5 years. If you do not have 40 quarters, you can pay for Part A. Premiums in 2021 are $471 if you have less than 30 quarters or $259 for people with 30 – 39 quarters.

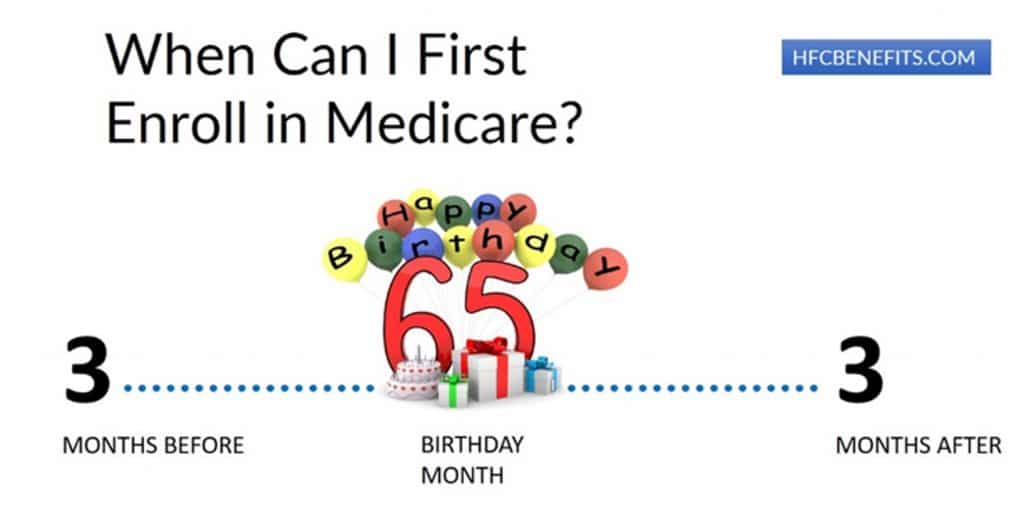

When do I enroll in Medicare Part A?

Enrolling in Medicare Part A is automatic for people already taking Social Security income benefits. Generally speaking, if you are already receiving Social Security, you will receive your Medicare card about 2-3 months before your 65th birthday. Keep an eye out for your Medicare card. It is a red, white and blue card printed on heavy card stock.

If you are not already receiving Social Security income benefits or Railroad Retirement income benefits yet, then you will need to actively sign up for Part A at age 65. You can do this at the Social Security website.

What is my Medicare Cost-sharing under Part A?

Remember, Medicare isn’t free. Your Medicare Part A coverage doesn’t pay 100% of your healthcare costs. You will have some cost-sharing you are responsible for.

Each year CMS determines the Medicare Part A deductible and coinsurance that you will be responsible for during the following year. These are the cost-sharing amounts that you must pay when using your Part A benefits. In 2021, you will pay:

A $1,484 deductible for each inpatient hospital stay when you have not been in the hospital during the previous 60 days.

$371 per day for days 61 – 90 of a consecutive hospital stay

$742 per day for days 91 – 150 of a consecutive hospital stay

Any and all costs for day 150 and beyond

Your Part A deductible is paid based on a benefit period. A benefit period begins the day you’re admitted as an inpatient in a hospital or Skilled Nursing Facility. The benefit period ends when you haven’t gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There’s no limit to the number of benefit periods.

For skilled nursing facility stays, Medicare covers the first 20 days. Your daily copay in 2021 for days 21- 100 will be $185.50. Fortunately, both Medigap policies and Medicare Advantage plans will help cover these costs. Either type of plan will help you to significantly reduce your financial exposure.