What is Medicare Part B coverage? It is your outpatient medical coverage for medically necessary healthcare services.

What is Medicare Part B? What does Medicare Part B cover? Many people think of it as medical coverage, but it actually covers things both in and out of the hospital. Think of Part B coverage as any care administered by physicians. Part B is optional, but if Medicare is your primary coverage, you definitely need Part B. You also cannot get Medigap supplemental coverage without it.

What Does Medicare Part B Cover?

Part B covers preventive care including flu shots, colonoscopies, mammograms and more. It covers ordinary outpatient things like doctor’s visits, lab testing, home health care, ambulance rides, and some chiropractic care too.

Medicare Part B also covers services that sometimes occur in the hospital. This includes things like:

Physician’s Services Radiation or Chemotherapy for Cancer

Surgeries Diagnostic Imaging

Drugs administered in a clinical setting, such as osteoporosis injections and insulin that is used with an insulin pump.

In most cases, outpatient prescription drugs will fall under Part D coverage. Part B pays 80% of approved Medicare costs after you first pay your annual deductible.

How Much Will Medicare Part B Cost?

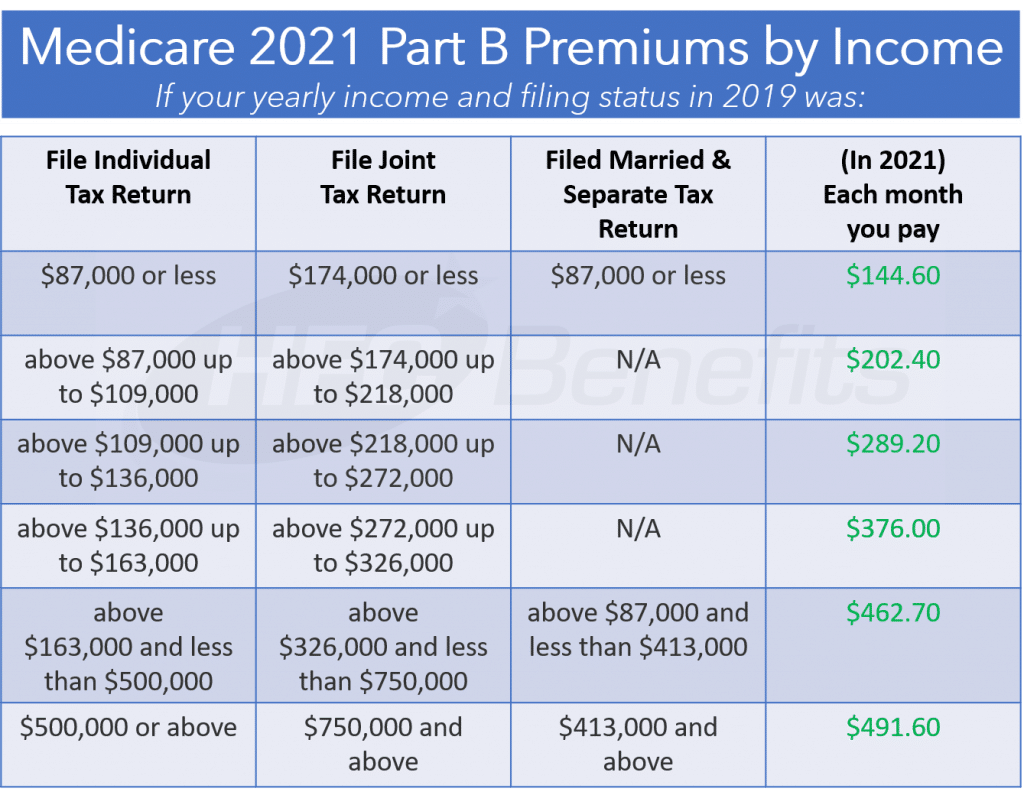

Your Part B cost is based on your income. For most people, in 2021, the base rate for Part B is $148.50/month for people new to Medicare. If you are in a higher income bracket, be prepared to pay more. Medicare will deduct your Part B premiums out of your Social Security check if you are already enrolled in your SS income benefits. If not, they will bill you quarterly. There is a credit card option at the bottom of the quarterly invoices.

When Do I Enroll in Medicare Part B?

Just like Part A, people who are already taking Social Security income benefits at age 65 do not need to enroll. The Social Security office will automatically enroll you.

Everyone else needs to apply for Medicare Part B themselves at age 65. Applying for Medicare Part B can be done online, over the phone or in person at your local Social Security office. After you apply, it will take 2 – 3 weeks before your card will arrive, so you should plan to apply several weeks prior to when you will need the coverage.

It’s important to enroll in Part B during your Initial Enrollment Period unless you have other creditable coverage. An example of other creditable coverage is an employer sponsored plan. If you enroll late into Part B, you may also have to pay a penalty for life. It’s important not to miss your enrollment window whenever you retire and lose access to your employer group health insurance.

If you failed to sign up for Medicare when you were first eligible, and you didn’t have any creditable coverage (employer coverage), you will be subject to the Medicare Part B late enrollment penalty. This penalty is equal to 10% per year for every year that you waited to enroll. This is a lifelong penalty.

When you missed your Initial Enrollment Period for Part B, you’ll need to wait for the Medicare General Enrollment Period to sign up for Part B. This period runs from January 1st to March 31st each year. Your benefits will then begin the following July. This can be a double whammy because not only do you now owe a penalty, but you have to wait several months for your coverage to kick in.

The best way to avoid the Medicare Part B late enrollment penalty is to enroll in Medicare during your Initial Enrollment Period. You can learn more about Medicare enrollment periods here.

What is My Medicare Cost-Sharing Under Part B?

You will pay a percentage of the costs of your medically necessary Part B services. In most cases, these costs are:

- Your annual Part B deductible ($203 in 2021)

- 20% of the remaining costs, with no limits or cap

- Any excess charges that a provider or facility may charge beyond what Medicare reimburses

The most important thing to keep in mind is the 20% you will owe for outpatient medical care. For services like surgeries or chemotherapy, your expenses can add up to thousands of dollars. In order to lower your overall cost and liability, there are supplemental coverage options available for any budget.