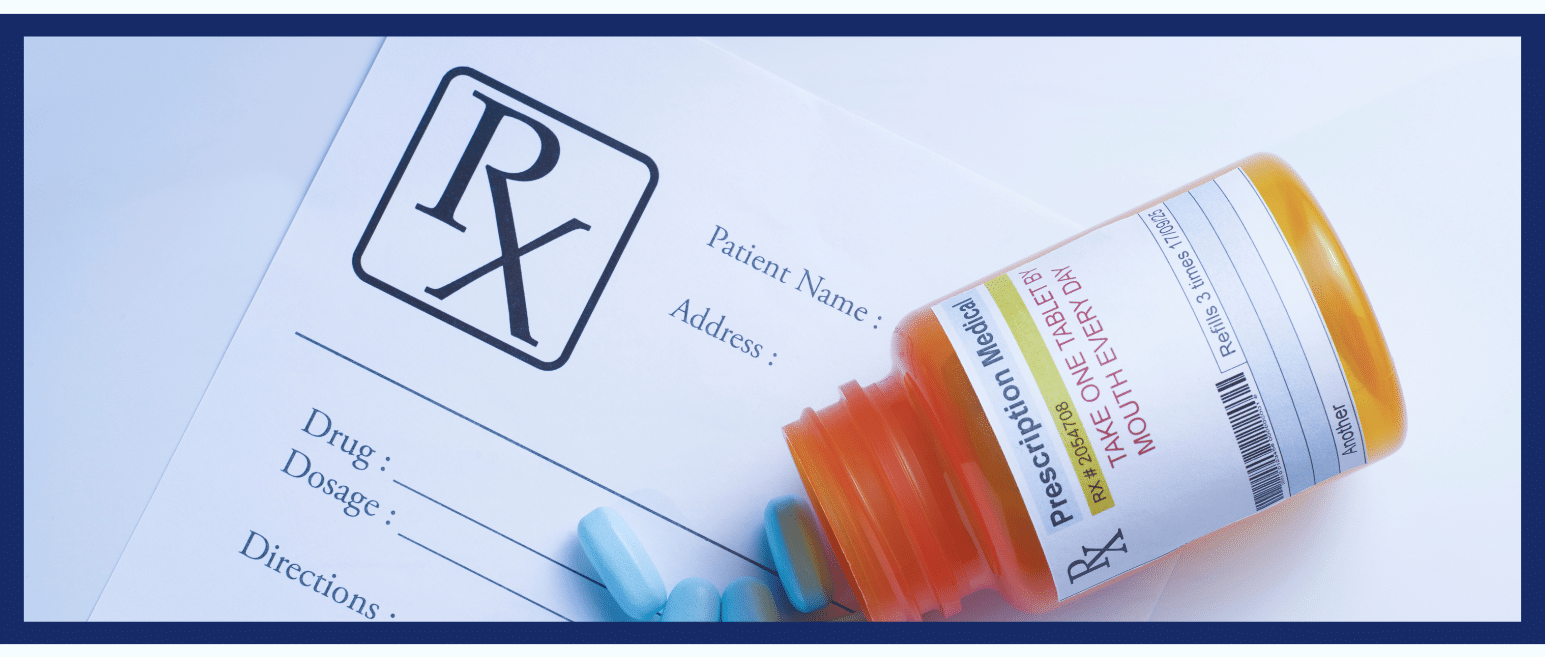

Medicare Part D Changes for 2025

What Lancaster, SC Residents Need to Know

Medicare Part D plays a critical role in helping millions of seniors manage the cost of prescription drugs. Every year, there are updates to the program, and 2025 brings some of the most significant changes yet for senior residents of Lancaster SC. These updates aim to make prescription drug coverage more affordable, transparent, and accessible for beneficiaries. Here’s a breakdown of the key changes to Medicare Part D in 2025 and what they mean for you.

New Benefit Design: A Three-Phase Approach

Starting in 2025, the standard Medicare Part D benefit design will follow a three-phase structure:

- Deductible Phase: You pay 100% of your drug costs until you meet your plan’s deductible.

- Initial Coverage Phase: After meeting your deductible, your plan will cover part of your drug costs until you reach a certain spending limit.

- Catastrophic Coverage Phase: Once you hit the out-of-pocket cap (set at $2,000 for 2025), you will enter the catastrophic phase where Medicare covers 100% of your drug costs for the rest of the year.

This new structure simplifies the benefit design and includes the much-anticipated $2,000 out-of-pocket cap, providing significant financial relief for those with high-cost medications.

Medicare Prescription Payment Plan

A new option for 2025 is the Medicare Prescription Payment Plan, which allows enrollees to spread their prescription drug costs throughout the year, making it easier to budget for out-of-pocket expenses. This feature will be available across all Part D plans and is a great option for individuals who prefer to manage their drug costs on a monthly basis rather than paying large sums all at once.

Base Beneficiary Premium for 2025

The base beneficiary premium for Medicare Part D in 2025 will be set at $36.78, capped at a 6% increase from 2024. While premiums may vary depending on the specific Part D plan you choose, this cap helps keep costs predictable and manageable for beneficiaries. The slight increase reflects the overall trend of rising healthcare costs but ensures that it remains within a reasonable limit for most enrollees.

Manufacturer Discount Program: A Key Change

One of the major program shifts in 2025 is the replacement of the Coverage Gap Discount Program (CGDP) with the Manufacturer Discount Program. Under this new program, pharmaceutical manufacturers will continue to offer discounts on brand-name drugs, but the way the program is structured will change. This aims to improve savings for beneficiaries and simplify the process for receiving discounts during the coverage gap, also known as the “donut hole,” which will be fully eliminated by 2025.

Elimination of the Donut Hole

For years, Medicare beneficiaries have had to navigate the confusing and costly “donut hole,” a coverage gap in which they paid a higher percentage of their drug costs. In 2025, this gap will be fully eliminated, meaning that once you reach the out-of-pocket spending limit, Medicare will cover 100% of your drug costs without any temporary cost spikes.

This, along with the $2,000 cap on out-of-pocket costs, means that seniors will experience less financial stress when managing their prescriptions.

What Do These Changes Mean for You?

The 2025 changes to Medicare Part D are designed to make prescription drug coverage more affordable, predictable, and easier to manage. Whether you’re currently enrolled in a Part D plan or considering one during open enrollment, these updates will provide important benefits:

- Lower Out-of-Pocket Costs: The new $2,000 out-of-pocket cap ensures you won’t spend more than that on prescription drugs each year.

- Easier Budgeting: The Medicare Prescription Payment Plan allows you to spread out costs, making monthly budgeting more straightforward.

- Greater Savings: With the new Manufacturer Discount Program and expanded access to interchangeable biological products, you’ll have more opportunities to save on medications.

- More Consistent Premiums: The base beneficiary premium cap helps ensure your costs won’t skyrocket from year to year, providing more financial stability.

Final Thoughts

With these upcoming changes, Medicare Part D will become more streamlined, affordable, and user-friendly for millions of seniors in 2025. Whether you’re concerned about high drug costs, dealing with a chronic condition, or just looking to ensure you’re getting the best deal on your prescription coverage, these updates will bring relief and improve access to necessary medications.

Remember to review your current Part D plan during open enrollment to see if it aligns with your needs for 2025. And if you have questions about these changes or how they might affect your situation, don’t hesitate to reach out to one of our Medicare Part D insurance experts who can guide you through the options available to you.